Brian Doe is Whole Planet Foundation’s Regional Director for Africa and the Middle East.

During annual field visits to our microfinance partners, we often see them searching for better ways to help their clients. Unexpected household shocks can seriously jeopardize the livelihoods of the poorest entrepreneurs and their families. The microfinance sector may be in its infancy in successfully providing access to financial products to buffer the effects of devastating health emergencies, floods, droughts, fires and other disasters, but we have seen innovative approaches from partners all over the world designed to mitigate these unexpected events.

The real impact of unexpected emergencies is often that households are forced to liquidate their personal and productive assets or stop working altogether for longer than expected. In these cases, funds may not be available to, for example, access health treatment after an illness or rebuild a home or business after a flood or fire.

In April the Asset and Market Access Lab at the University of California Davis and BRAC microfinance with funding from USAID released this short summary of their research into a variety of products and strategies designed explicitly to help poor entrepreneurs overcome emergencies. One strategy they present is to offer pre-approved emergency loans that would be triggered when major external shocks such as flooding hit communities where BRAC’s clients are located.

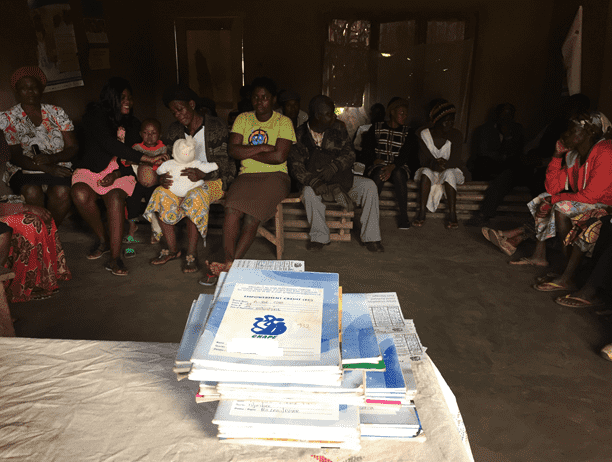

This month I had the opportunity to visit Whole Planet Foundation’s microfinance partner GHAPE in northwest Cameroon. GHAPE offers basic group business loans and micro-savings services to men and women in rural Cameroon from their headquarters in Bamenda. Their services are actually quite similar to the microloans offered by BRAC but were developed locally in this part of Central Africa. I was quite surprised to find out that built into GHAPE’s founding operational strategy was the idea of emergency loans. Each loan group has access to a small, no-interest loan fund to offer to members when they need to cover unexpected personal emergencies over the course of managing their GHAPE business loans. These emergency loan funds have proven very successful for both GHAPE and their microcredit clients.

During my visit, I met Regina, a maize farmer and owner of a small local canteen. She is currently managing a $170 loan with GHAPE to support stocking her restaurant. Over the course of her multiple loans accessed through the GHAPE Loan Center, she has managed to meet the costs of unexpected hospital visits and necessary medicines through very small withdrawals from the emergency loan pool GHAPE offers through her loan group. She reported requiring about $10-$20 each time.

Regina with her grandson harvesting from her garden in preparation for her restaurant menu. Photo: Brian Doe

These small emergency loan requests are approved quickly by the other members in her group in partnership with a GHAPE loan officer, cannot exceed about $75, and are repaid one month later. They also carry no interest. The group has a separate register for tracking and managing the basic emergency loan fund. From what I could gather from my visit, this strategy not only seems useful to GHAPE’s members but also helps to increase microcredit clients’ loyalty and trust in the organization.

GHAPE’s founder devised this solution in a context where offering health insurance or other more complex loans for non-business purposes isn’t yet practical or feasible. GHAPE is an extremely socially motivated business loan provider and, like other similar MFIs, is trying to better meet the needs of poor entrepreneurs in underserved communities. It is exciting for me to see how the microfinance sector from the largest players like BRAC- which WPF has supported in Asia and Africa – to much smaller community organizations like GHAPE in western Cameroon will lead the way in tackling the real challenges faced by their clients.