The PAMF branch in the northern town of Korhogo.

Last month I went Cote D’Ivoire to visit WPF long-time microfinance partner PAMF, who administers group microloans to rural entrepreneurs and farmers. This visit allowed me to observe the initial roll-out of a new mobile phone-based platform that WPF provided grant funding to help build. The platform will allow anyone with a cell phone to repay loans or deposit savings into PAMF accounts without having to travel to a PAMF branch office. WPF also has provided growth capital to finance rural loans taken by these groups since 2013.

WPF decided to provide a grant for building a mobile platform because while many worry about the burden of interest rates charged on microloans (and much of West Africa tightly controls and limits these rates), for rural customers it is often the cost of getting from a village to a local finance organization that is most prohibitive when trying to afford a farm loan or to make a deposit into a savings account. Mobile phone access in rural communities presents an opportunity to reduce these costs.

The High Cost of Access to Finance for the Rural Poor

During this visit I traveled to villages around the northern town of Korogho to learn how PAMF serves these communities despite the high cost of accessing them and the long distances between the region’s villages and the central town centers where PAMF has branch offices. I learned that farmers in these villages pay a minimum of $4 in fuel to go into town each month on their motorbikes to manage their agriculture loans or to deposit savings into their accounts. This cost of travel greatly increases the cost of financing a small rural farm. In addition, it takes upwards of 2 hours to make the round trip into town and the journey on dirt roads wears on their motorbikes.

PAMF’s limited operating budget and security considerations for their field staff prevent credit officers from bringing loan disbursements directly out to village clients or from collecting monthly reimbursements of loans where clients’ farms are located. It would certainly be too costly for the program to collect very small savings deposits regularly from its over 42,000 depositors across northern Cote D’Ivoire. PAMF field staff typically visit clients three times during the course of a business loan to provide regular oversight of its enterprise loan program and these staff do not handle money during these visits. This is essentially what PAMF can afford to do in terms of visits to village customers.

Traditional rural granaries used by farmers to store their harvests.

Finding Solutions: Group Lending and Mobile Banking

Traveling by motorbike can be expensive and time consuming.

While most other microfinance institutions (MFIs) have stopped serving very small enterprises in rural villages, PAMF first combatted this problem by organizing PAMF borrowers into loan groups that could jointly contribute to cover the cost of only 1-2 members going into town to make monthly loan reimbursements and deposits into savings accounts on behalf of the whole group of 7-15 members. This strategy allowed PAMF to continue serving rural farmers with farm loans that are typically less than $700 per year.

However, another strategy is emerging that can greatly reduce the impact of the distance between rural businesses and PAMF’s financial services. In many other countries in Africa, microcredit clients are already making their loan repayments or savings deposits by mobile phone with a system of ‘mobile money’ managed by cell network operators. However, PAMF found in Cote D’Ivoire that these new technologies with the potential to benefit rural communities were slow to evolve, particularly in the remote northern areas where PAMF is most present.

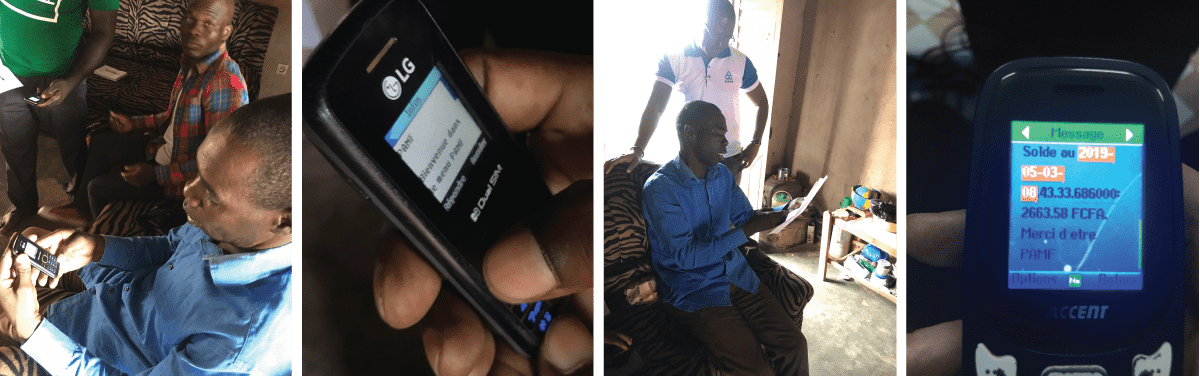

PAMF decided to make mobile banking a reality in Cote D’Ivoire themselves, so they approached local mobile operators to build out a system where their clients would be able to reduce their visits to PAMF offices. Four years later, after lengthy negotiations, development challenges and multiple program trials, PAMF is training rural farmers on how to access their PAMF accounts with just a simple mobile phone on a platform they call a ‘Mobile Wallet’.

Agriculture clients access their loan and savings accounts with their mobile phones.

The basic functionality of this new mobile service allows clients to give their cash loan repayments or savings deposits to a mobile money representative in their village so that they can then transfer these funds directly into their PAMF account. Over time PAMF will add more services to the platform to reduce the sums of money traveling long distances across rural roads. PAMF has worked hard to negotiate beneficial rates for making these transfers with a cell phone affordable and the cost of around 30-40 cents per transaction is vastly more affordable than what farmers pay for fuel to travel to a PAMF branch.

In West Africa it is expensive to work in rural communities and there are limited options available to rural businesses seeking capital to grow their enterprises or farms. PAMF is a leader in finding ways to overcome obstacles to access despite the organization’s own difficulties to cover high operating costs. Now PAMF will expand access to secure savings accounts and affordable business capital to anyone regardless of their location, thanks to the mobile wallet platform they have launched.

The Future of New Technology in Group Lending

Foremost, the immediate concern WPF addressed when deciding to fund the development of the mobile phone platform was the cost of taking a loan for the thousands of rural entrepreneurs and farmers PAMF is working with. Ultimately, WPF felt the new technology would allow more rural populations to open savings accounts where access is otherwise non-existent.

However, as I learned more about PAMF’s mobile banking system, I asked myself: Will new technologies such as using mobile phones to manage microloans change the role of loan groups in microfinance? Will it break down the system of loan groups if each member can send money to PAMF with their own mobile phone?

Recently, I came across this article about a microfinance institution called SAJID in Bangladesh that has also traditionally served customers in loan groups and recently decided to offer cashless repayments with mobile phones. SAJID struggled to determine what the role of their loan groups would be if each member could independently manage their business loans from their own mobile phones.

Ultimately the article (and the microfinance institution) concluded that there are huge benefits to keeping borrower loan groups even when their role facilitating repayments or deposits is no longer needed. The groups still lower the cost of oversight visits by MFI staff, they help with explaining processes and procedures across members, allow for word-of-mouth marketing, and other benefits. At PAMF, the group structure also allows clients to avoid any complex guarantees on their enterprise loans by mutually guaranteeing repayment of the loans.

At Whole Planet Foundation, we seek out microfinance partners that are not afraid to challenge their ways of working to better serve marginalized communities. The evolution of how PAMF in Cote D’Ivoire has continually confronted obstacles to their clients is why WPF has continued to support their work since 2013. PAMF is only starting its roll-out of mobile phone based services to loan groups in Cote D’Ivoire and it will be interesting to see how their group model will be impacted by these new technologies.

Interested in learning more about mobile banking and how it can integrate with traditional group lending? Check out this recent post from WPF’s Zoe So about mobile banking in Kenya.