The Merriam-Webster dictionary defines poverty as “the state of one who lacks a usual or socially acceptable amount of money or material possessions.” However, what is “usual” or “socially acceptable” can vary quite a bit from one person, family, or community to the next, and certainly from one country to the next. We are thus compelled to use some sort of criteria or thresholds, formally or informally, to help us define poverty as it exists in different contexts.

While most of us generally consider the United States to be a “rich” country by global standards, and while this is true by several measures, many people in the U.S. still live in poverty. By one widely-recognized, cited, and applied measure, that of the U.S. Census Bureau, 38.1 million lived in poverty in the U.S. in 2018, and while estimates and opinions on the matter vary, there is little doubt that the current coronavirus pandemic is contributing to a marked rise in the number of people in the U.S. – not to mention the whole world – lacking “usual or socially acceptable amounts of money”.

The Likeliest and Unlikeliest of Times: Joining Forces During the Great Recession

The United States is one of the 77 countries around the world where Whole Planet Foundation (WPF) is actively supporting the alleviation of poverty through microcredit. For well over a decade, we have been working closely with our U.S. partner, Grameen America.

Photo at the top of this post: Members of Grameen America’s Jackson Heights Branch in 2018.

Building on the legacy and successful solidarity-group lending model of Nobel Peace Prize Laureate Muhammad Yunus, Grameen America offers collateral-free microloans ranging from $2,000-$15,000 to women who run small businesses across the United States. Grameen America specifically aims to support entrepreneurial women living below the federal poverty line, with little or no access to credit in the mainstream financial system.

In 2008, when the world was in the thick of the Great Recession, WPF supported Grameen America’s first branch office with a grant for $150,000 to increase their microloan portfolio. These operations are in Jackson Heights, a multicultural micro-neighborhood in the borough of Queens, New York. At the time, nearly a quarter of the people living below the poverty line in the US were first-generation immigrants and their family members.

Solidarity group members at a meeting at Grameen America’s Jackson Heights location in 2018.

This reality is not materially different today. Of the US’s poor immigrant population, approximately half is female. These women are among the lowest paid in the US workforce, yet their economic contributions are essential not only for the survival or upward mobility of their families in the US, but in their home countries as well. In late 2019, remittances from the US sent to low and middle income countries around the world, such as El Salvador, Egypt, Haiti, India, Mexico, Nigeria, and Tajikistan, reached approximately $150 billion.

They Emerged, and They Flourished

Today, twelve years after Grameen America opened its doors in Jackson Heights, the organization has an impressive, much-expanded footprint across the United States, with 23 branches across 15 U.S. cities. During that time Whole Planet Foundation has supported them with $5.7 million in grants for revolving loan capital, helping develop 17 of those branches as they work towards self-sufficiency.

As of June 30, 2020, Grameen America’s 23 branches have served more than 132,000 women across the US with over $1.5B in small loans to support their small businesses. Keeping its focus on underbanked women and adhering to the critical elements for success of Professor Yunus’ group lending model, Grameen America has also been able to maintain impressive repayment rates consistently over 95% across their branches’ portfolios. This high level of repayments further allows Grameen America to re-lend the recovered loan capital, making nearly all of it available again to entrepreneurial women so they can continue working towards a higher quality of life for themselves and their families, thus adding that much more value to the economy.

Recent Support of Grameen America

The most recent Grameen America branches which WPF has supported with loan capital are in Fresno (the office there opened in October 2019) and Long Beach, California (which opened in September 2019).

Fresno is the largest city in California’s agricultural Central Valley; it has a diverse and growing population with significant levels of poverty and low wage working families. Nearly 1 in 4 residents of Fresno County live in poverty (at just under 25%).

The third Grameen America office established in the Los Angeles metropolitan area is the one mentioned in Long Beach, which is the second largest city in that region. The poverty rate there is 18.8%, with Hispanic females making up the largest demographic living in poverty.

Embracing Innovation through Technology

A big part of what has allowed Grameen America to grow its efficiency and impact is their focus on utilizing practical, powerful technologies to ease and accelerate the execution of their model. As one might expect, when Grameen America first began to apply Grameen methodology in the 21st century U.S. (Professor Yunus developed the model in Bangladesh in the early ‘80s), they utilized most of the “tried and true” elements of Grameen banking, such as their trademark blue-green record-keeping passbooks for every borrower, manually-updated accounting ledger books, and cash-only loan disbursements and repayment installments. However, it quickly became clear that adaptation of the model would be needed to have a lasting, positive impact in the new, different culture and environment that is Queens, New York.

From that starting point, aided by the application of new technologies, Grameen America has evolved a good deal and today operates very differently than it did when it launched over decade ago. They are now a 100% cashless operation. All members nationwide receive loans through pre-loaded cards which can be used like debit cards, allowing them to expend the total amount of their loan over a series of digital transactions. Grameen America members now repay loans via cashless options and receive text receipts for their transactions. By interacting with digital and cashless systems during Center Meetings on a weekly basis, members build familiarity with and begin to trust digital systems.

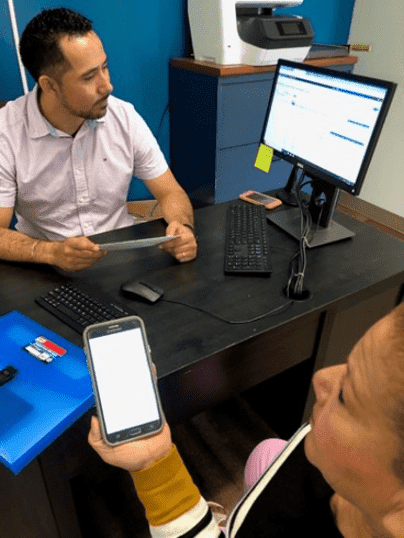

Grameen America HOUSTON BRANCH MANAGER DAVID ACOSTA, PROCESSING A LOAN DISBURSEMENT WITH A MEMBER-BORROWER, APRIL 2019

By going cashless and paperless, Grameen America’s field officers now have more time to deliver education and training to their members. At WPF we highly value our microfinance partners’ emphasis on, and delivery of, what we often call “credit plus” services to its members. That is, what our partners provide for their clients including not only loans for their small enterprises, but also education-, health-, and business-enhancing courses, materials, workshops, etc. These “plus” components of an MFI’s operations can act in synergy with the loans they disburse (and we have directly seen in many cases that in fact they have), to enable greater and longer-lasting positive outcomes for the women member-borrowers, their families, and their communities.

“Necessity is the mother of adoption”

As for most all organizations to varying degrees, the COVID-19 pandemic has greatly affected Grameen America’s working landscape. It has been particularly acute for Grameen America for many reasons, one of which is the large relative presence they have in New York, with over 20,000 current members in this part of the U.S. which has experienced some of the worst effects of the coronavirus.

As the COVID-19 situation escalated in March of 2020, Grameen America (which incidentally, has its headquarters in New York City) quickly responded to continue serving the women entrepreneurs they support all over the U.S. in several innovative and practical ways, resulting in the continuation of microloan disbursements, repayments as possible, business advice and other trainings — all for the first time in 100% virtual manner. This required increased use of technologies they had already developed and implemented, such as phone text messages to borrowers to confirm a completed loan installment payment and updated loan balance; as well as quickly reacting to the current crisis by activating new tools and measures to help them continue delivering essential capital and engage borrowers virtually, allowing them to connect, discuss challenges, encourage, support, lead and learn from each other during this challenging time.

In late March during a call between members of Grameen America and Whole Planet Foundation, Andrea Jung, the President & CEO of Grameen America gave us an impressive, inspiring update, describing to us how the team has pivoted quickly and effectively during the pandemic. One of Andrea’s statements in particular resonated with me: “Necessity is the mother of adoption.” As economic activity in cities across the U.S. continues to be greatly diminished, low-income women entrepreneurs and their families have been enduring some of the hardest financial consequences. With the objective of supporting the resilience and recovery of small businesses across this country, Grameen America is doing much more than just continuing their core services with enhanced use of technology. In addition to fully implementing a virtual model of program delivery to support the 52,000 women entrepreneurs they serve, Grameen America has:

• Lowered the interest rate on existing loans to 0%, offering loan extensions to members who are unable to make their weekly repayments, and covering all member costs to digital repayment vendors to support safe, virtual operations. These changes give their members the flexibility to deploy their business capital where and when it is needed the most, with no concern for interest costs or external repayment fees; and

• Launched the Grameen America Economic Relief & Recovery Fund, with the goal of raising $72 million to help them continue providing essential capital and services to their members.

At Whole Planet Foundation, we are impressed and proud of the work Grameen America is doing to support low-income entrepreneurial women in the US. They have re-confirmed for us that a small amount of credit, ideally coupled with the sharing of new, useful knowledge with the borrower, can create disproportionately large and beneficial returns in both the short and long terms — truly for all of us in our ultra-connected global community.

All photos courtesy of Grameen America.